A Pre-mortem on the Meme Stock Bubble

March 9, 2021

Photo by Lloyd Blunk on Unsplash

Disclaimer: this article does not constitute financial advice.

What is a speculative bubble?

A speculative bubble is a spike in asset values within a particular industry, commodity, or asset class to unsubstantiated levels, fuelled by irrational speculative activity that is not supported by the fundamentals.

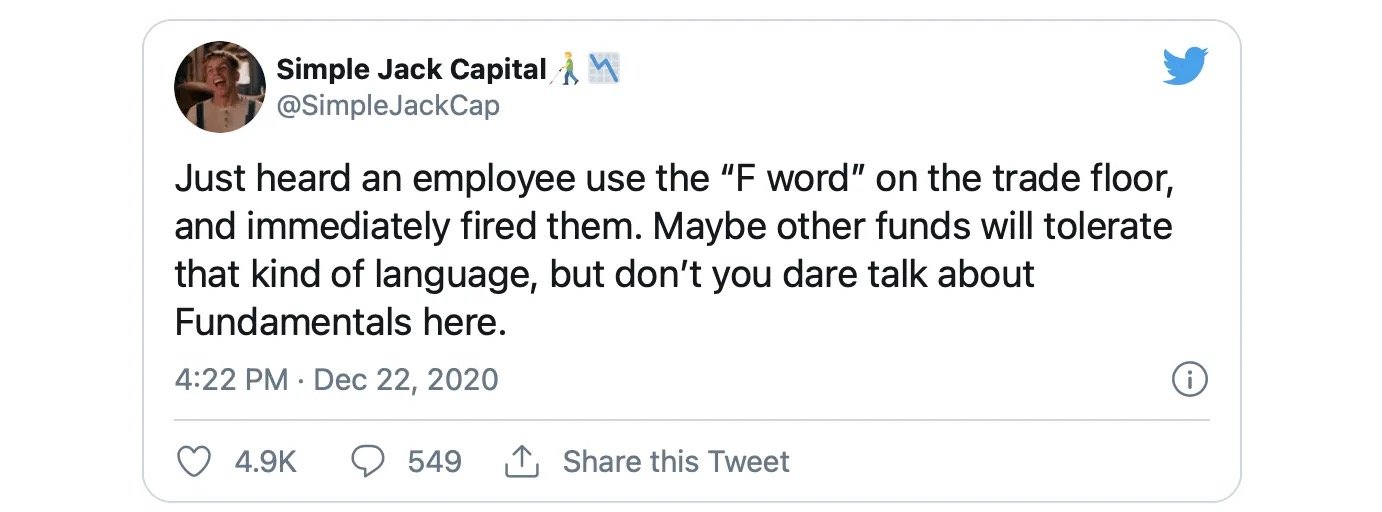

The tweets from this era will one day hang in the Museum of Speculative Bubbles.

With Fundamental Analysis, we try to determine a stock’s real or “fair market” value using various macroeconomic factors, the company’s revenue streams, balance sheets, and debt obligations, and industry position. The goal is to reach a point where an (intelligent) investor can determine if a company is overvalued or undervalued given its current market price. The belief of fundamental analysis is that eventually the market will correct itself, or return to the “fair market” value, because eventually all investors will realise that a particular stock is either overvalued or undervalued and behave accordingly.

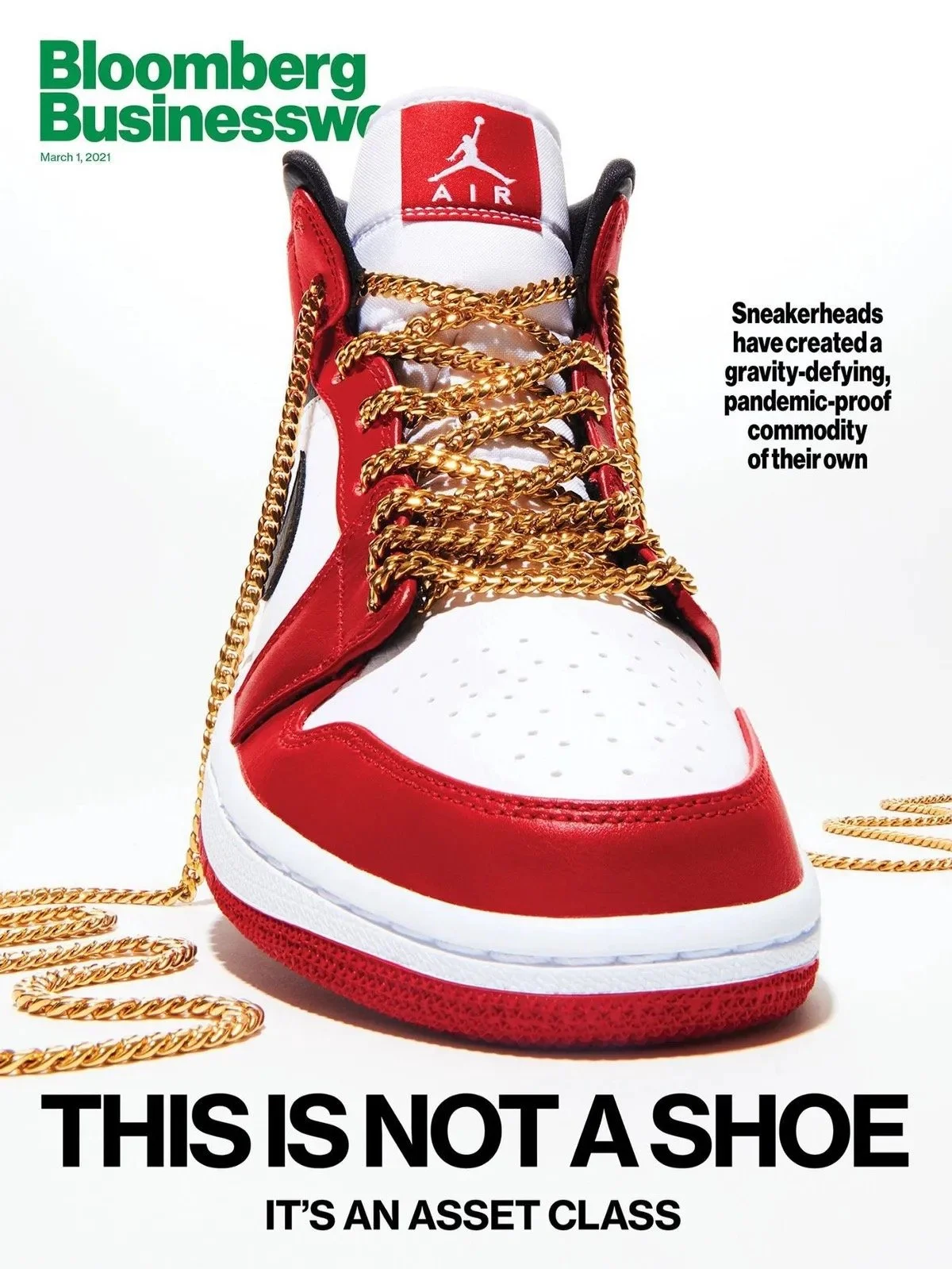

Savvy “investors” are buying up rare sneakers at cost or discount and reselling them to collectors. Some limited-edition sneakers go for up to $10,000. I found this on Twitter, with the caption “Headlines you don’t see during a bear market“ or something to that extent. Unfortunately I cannot find this tweet to attribute the quote.

With speculative bubbles, investors buy stocks because they see the price going up, and not because they necessarily believe it is fundamentally sound. The euphoria of speculative bubbles tend to make investors more irrational and less risk-averse. A belief that an asset class will always defy gravity drives investors to buy more of already-overvalued stocks, thinking there will always be someone willing to buy the asset at a higher price.

Even the media, the gatekeepers of truth, fall for the euphoria. A sign of the times is this graphic depicting “Sneakers as an asset class”, which I discovered while scouring Twitter. The Tweet simply said, “headlines you don’t see at bottoms”. Here, the “bottoms” refer to periods of negative sentiment in the stock market, where growth is flat or even heading downwards. No one spoke about “gravity-defying asset classes” post DotCom Bubble, that’s for certain.

Meme Stock Mania

Normally, speculative bubbles are notoriously hard to recognize while happening, but seem obvious after they burst. But this one has been glaringly obvious. Its been meme-worthy, to say the least. An early warning sign was the rapid rise of Tesla’s share price, and the cult following that its CEO, Elon Musk started to amass. Between January 2020 and January 2021, Tesla’s share price rose 750%. At some point, its market cap exceeded the combined market cap of the top 9 car manufacturers in the world.

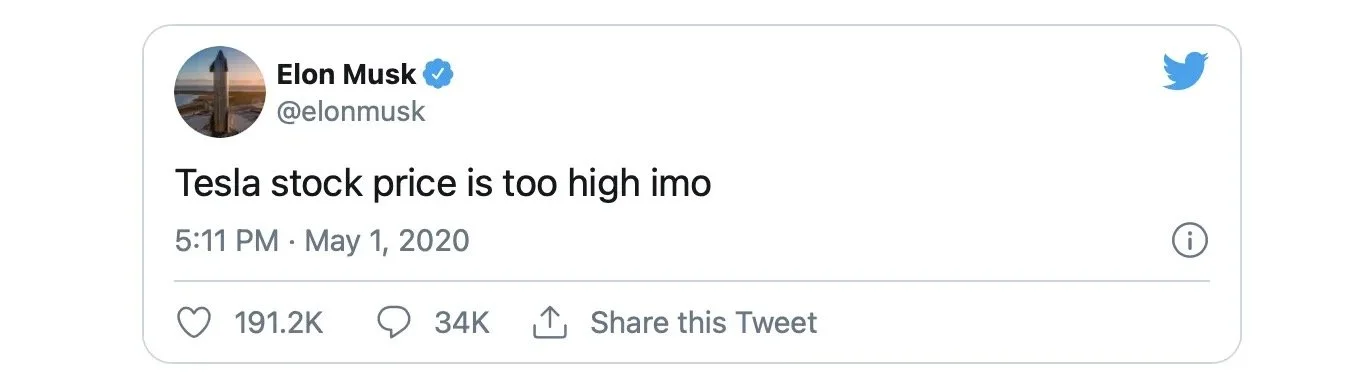

The impact of Musk’s tweets on the stock market revealed how truly bizarre the current investor landscape had become. On May 1, 2020, Elon Musk tweeted the following:

This resulted in Tesla’s share price closing down by 10.3%, on the day. He pulled a similar in June 2020, with similar effect. In August 2018, Musk posted about Tesla “going private, funding secured” at $420 a share. This was just a joke (apparently) but it cost him his role as chairperson. In meme culture, “420” is used to refer to cannabis or to the act of smoking cannabis.

I highlight Tesla because it seems, to me at least, to be the spark of this meme stock bubble. Or at least smoke telling you there’s a fire somewhere. Meme stocks are called as such because its basically for the LOLs. It’s a meme that has gone viral.

How did we get here?

Low yields in money markets have forced investors to look for alternative, more risky instruments to protect their moneys from inflation. That, combined with the additional disposable income that people have because they were sitting at home for the better part of the past year, plus the growing frustrations due to wide-spread job losses, growing debt and grim economic outlooks saw more and more individuals becoming “retail investors”. Fee-free trading platforms, like Robinhood, made it very easy for novice investors to get started with their trader journey. Suddenly, the stock market was being pumped full of money from investors who lived for the most basic form of technical analysis:

Buy cause it’s going up, sell cause it’s going down.

Retail investors piled onto growth stocks like Apple and Amazon, each of which has grown approximately 1200% over the past ten years. Valid thinking — given that these two highly innovative companies have healthy revenue streams and considerable market share— although the sheer force of their collective efforts pushed these stocks into the overvalued region. Apple’s share price more than doubled in less than a year, from a low of $56.87 on March 21, 2020 to a peak of $145.09 on January 15, 2020. Which is fine. It’s a free market, right?

Photo by Pierre Borthiry on Unsplash

Emboldened by zero-commission trading, less rigorous margin requirements and an app that gamifies trading, meme stock investors evolved their strategy:

Buy because we want to make it go up.

Now, usually small time investors don’t have big influence on market movements, because their small, individual trades are uncoordinated and largely cancel each other out. But what if millions of traders around the world starting sharing notes and coordinating attacks? This is exactly what happened with meme stocks. Retail investors started buying up shares of not-so-fundamentally sound investments, like AMC Entertainment Holdings, BlackBerry, GameStop, and Nokia. What many of these companies have in common is anaemic financials, declining market share, and lacking innovation in the new economy. Wall Street knows this and had rightly shorted many of these meme stocks. r/WallStreetBets knows that Wall Street has shorted many of these stocks, and decided, for no particular reason, that they will be taking on Wall Street.

Take GameStop. GameStop is an American retailer that specializes in video games, consumer electronics, and gaming merchandise. At one point, it was the most heavily shorted stock in the S&P 500. r/WallStreetBets, with literally millions of subscribers, took notice of this stock, with a little help of Michael Burry (the guy from The Big Short movie).

On the 1st of December, Game Stop opened at $19.96. By 28 January, it had peaked at a high of $483.00, a more than 23,000% increase. This Godzilla-sized rally caused a short-squeeze for those who were bullish (Big Money hedge funds and investment firms) on GameStop’s future. From Investopedia, cause I can’t explain it better myself:

A short squeeze occurs when a stock or other asset jumps sharply higher, forcing traders who had bet that its price would fall, to buy it in order to forestall even greater losses. Their scramble to buy only adds to the upward pressure on the stock’s price.

Even Elon Musk got in on the fun, a link to the WallStreetBets thread on GameStop. This brought the GameStop saga to peak exposure, and resulted in a 100% increase in the share price during after-hours trading.

The Tweet that catapulted WallStreetBets into history

The story does not end there. The stock might have peaked even higher, had Robinhood and other easy-trading platforms not restricted trade on several meme stocks, including GameStop, AMC Entertainment ,and Nokia. A congressional hearing on the events started on 18 February.

No one really understands why WallStreetBets decided to take on some of the most powerful financial institutions in the world. Was it a sophisticated market manipulation strategy, a class war on institutional investors, a long term troll, or just a joy-ride to the moon for the LOLs? “It certainly started as a meme. That’s how WallStreetBets operates,” Jaime Rogozinski, who created the subreddit, told Wired.

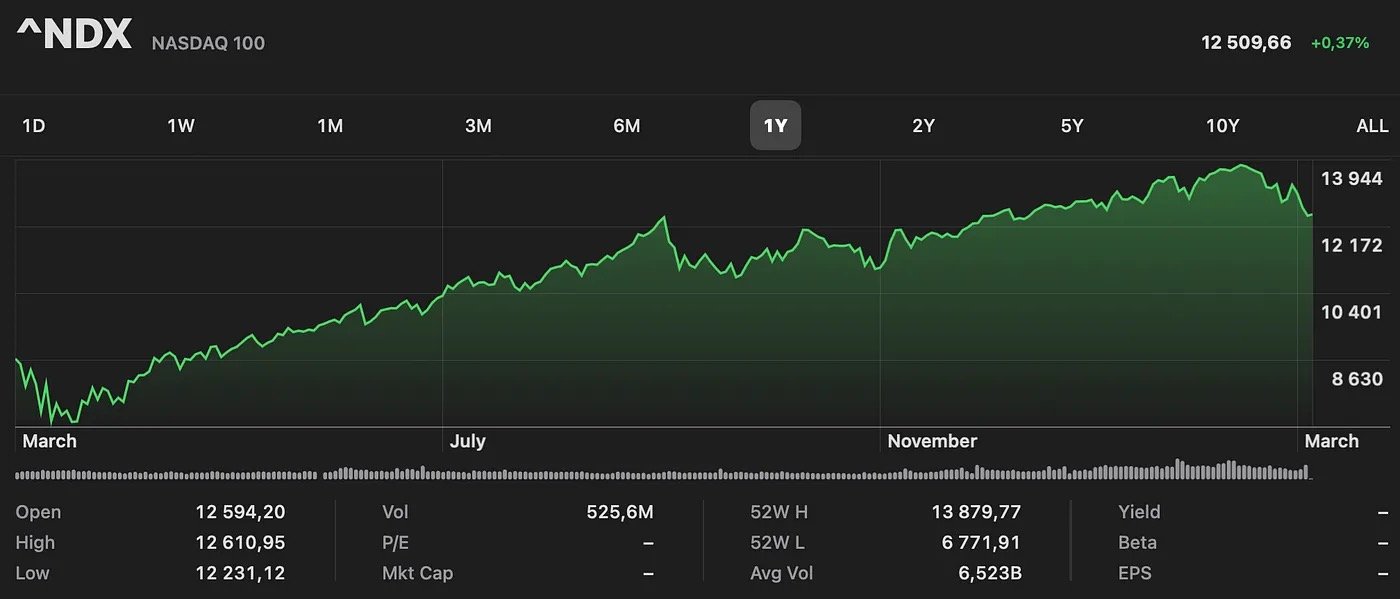

Nevertheless, this reckless behaviour is indicative of a much larger problem. The stock market has, indeed, become violently dislocated from reality. We are certainly in the end game now. One need only look at the charts to understand how nostalgically bizarre things have become. From its lowest point of $6771 to its highest point of $13879 this past year, the Nasdaq 100 essentially doubled in value. The last time the Nasdaq did this was in during the DotCom Bubble.

The Waiting Game

For the past year, believers in fundamental analysis kept looking at the price charts, saying, “It’s gonna come down any day now…”

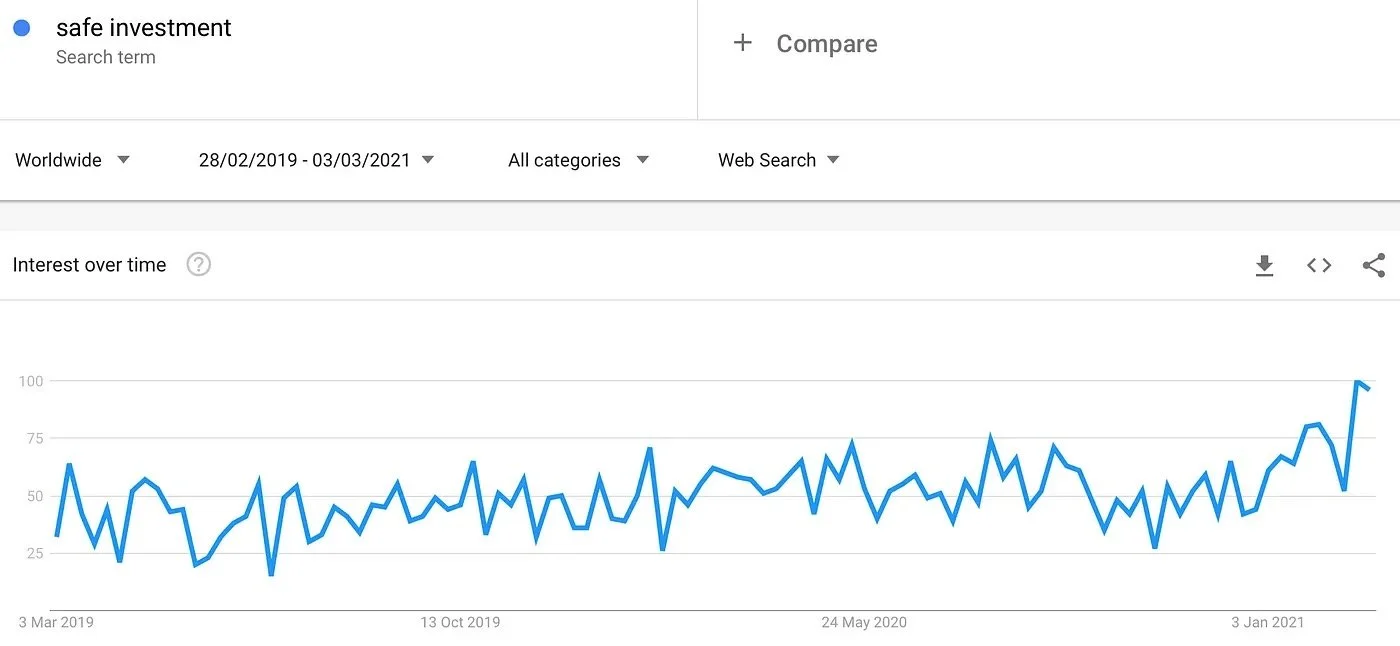

Google Trends serves as a good proxy for what the general population is thinking. It has been used to successfully track outbreaks of viruses in different countries (because people search for symptoms, etc). It can also be used to gauge market sentiment. Right now, the world seems to be desperately concerned with finding “safe” investments to put their money in, should a crash be coming. Search volumes for the term “safe investment” is at its highest in 2 years.

Google search volumes over time for “safe investment”. Created on 03/03/2021 by Author.

Dala what you must, but this graph tells me that investor fear is at an all-time high. And with good reason. All major stocks, including Apple and Amazon have seen massive declines over the last month. Tesla’s epic bull run has seen a decline of 25% over the past month. Even Michael Burry is short on Tesla. Coincidently, he was long on GameStop before the whole short-squeeze saga.

Every bubble in history has popped spectacularly and, more importantly, eventually. We haven’t seen the crazy single-day double-digit declines that ended many of the previous speculative bubbles. But after much a hoo-ha, people seemed to have quietly accepted that the stock market won’t be going up like it used to. Perhaps the madness has finally come to an end.

Closing remarks

For a long time, I have been monitoring the stock market and wondering whether or not we are in a bubble. Bitcoin rising and then the GameStop mania was the final piece of the puzzle. I was in quite a rush to finish this article because I was terrified there would be a massive crash, and then I would have had to think of a new title! For those interested, a pre-mortem is quite literally the opposite of a postmortem/autopsy.