The Ronaldo Effect

June 21, 2021

An interesting phenomena happened last week: Coca-Cola saw its share price drop from $56.16 close of Friday, 11 June, to about $55.30 during opening on Monday, 14 June (a 1.6% drop or $4BN loss in market value).

At the same time as the markets opened on Monday in New York (9:30AM EST), Ronaldo was getting ready for his soon-to-be memorable EUFA 2020 press conference in Budapest. What would happen next would capture the world’s imagination, literally.

What happened, exactly?

Let us unpack the facts:

At 9:40AM EST, Coca-Cola’s stock price was $55.26 (down 1.6%).

At 9:43AM EST, Ronaldo picks up the two Coke bottles, moves them away, picks up a bottle of water, and says “Agua!” to the audience.

It is worth noting that Coca-Cola is one of the major sponsors of the European Championship, which explains the strategic brand placement.

Watch the clip below:

The action itself was not news worthy — “Athlete chooses water over fizzy drink”. But because it was Cristiano Ronaldo, one of the most famous athletes in the world, and because it was Coca-Cola, the largest producer of sugar beverages, the event was news worthy. Investors know that with a four letter word (not Coke, Agua) Ronaldo has the influence to sway millions of consumers to live healthier, and that scares investors and analysts alike.

Many news outlets, like The Independent, The Telegraph, The Guardian, and ESPN attributed the 1.6% drop over the weekend to Ronaldo’s preference of water over Coke. The ESPN article was cautious to not infer causality, by stating “Cristiano Ronaldo’s removal of two Coca-Cola bottles … coincided with a $4 billion drop in the market value of the American drink giant.” The news quickly spread beyond conventional sources and onto social media.

Ronaldo promoting Coke, early 2000s

It’s just such a perfect story. It feels like poetic justice as conglomerates have long used professional athletes to promote their unhealthy products to impressionable fans around the world. In fact, promoting sporting events like EUFA is reportedly part of Coke’s strategy to be perceived as healthier. Then, a superstar like Cristiano Ronaldo, who used to promote Coke, tells his fandom to rather water.

You can’t trademark water, can you?

But it simply is not accurate to attribute Ronaldo’s stunt to the initial 1.6% drop in Coca-cola’s value. The timelines do not match up.

Why was Coca-Cola really down?

14 June 2021 was ex-dividend date for Coca-Cola. This means that if you held Coca-Cola shares up until 11 June (the previous trading day), you qualify for a dividend payout of 42c per share. Now, usually stock prices drop by the expected dividend payment to reflect the discount (the share price is now slightly less valuable to those not entitled to the dividend). Sometimes investors also sell their shares after the ex-dividend date, which could push the price down further. This is the more likely cause for the initial 1.6% drop in Coca-cola’s share price, prior to Ronaldo snubbing the sugary beverage on live TV.

It doesn’t matter, because memes

However, facts do not matter here. As I explained before, the story is so perfect, it sells itself. It went viral. Memes were everywhere. (See a compilation of the funniest memes here.)

As the story grew bigger, it became more believable. Reputable news sources continued to report on the phenomena of Ronaldo snub causing Coca-Cola’s share price to drop, adding fuel to the flames.

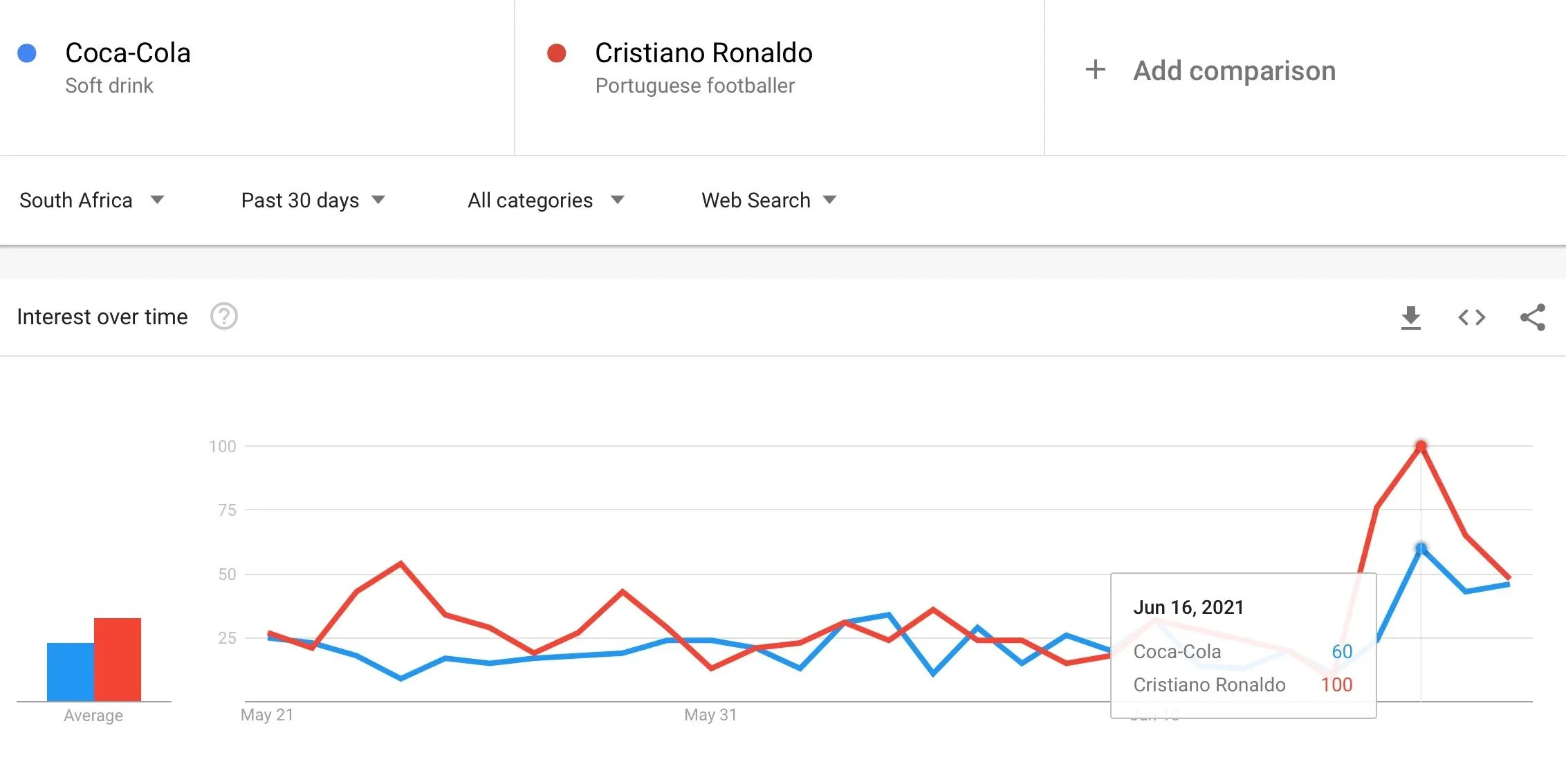

Based on Google Search Trends for Coca-Cola and Cristiano Ronaldo, I would guess that the story reached peak viral status on 16 June 2021, before interest slowly started to wane.

Google Search Trends for Coca-Cola and Cristiano Ronaldo, sourced on 21 June, 2021.

Whether Cristiano Ronaldo really moved Coca-Cola’s share price with his Agua stunt or not, did not matter. News sources never even paused to verify their claims, because everyone else was reporting it, so it must be true. It was reported so wide-spread that it was accepted as fact, which demonstrates two sad realities: the truth is what the majority believes it is, and journalists are no longer as rigorous in their fact-checking.

As this article by Forbes described it, we live in a post-truth world: where objective facts are less influential in shaping public opinion than appeals to emotion and personal belief.

The lie becomes the truth

The Ronaldo Effect was so profound that the fake news became a self-fulfilling prophecy: the following week, Coca-cola’s share price continued to decline, to a $53.77 close on Friday 18 June. This represents a 4.3% decline in a single week, while the S&P500 was down only 1.87% over the same period. In fact, Friday 18 June saw the largest trading volume in a single day for the past month.

There is no other plausible explanation, besides the fact that the story of “Ronaldo snubbing Coke causing them to drop 1.6%” made investors panic big time. Fear in the stock market is like a snowball — panic selling is contagious. As the stock price continues to drop, more investors start to doubt the future of Coca-Cola, given the impressive impact a single sport star could supposedly have on the share price of said conglomerate. They, in turn, sell as well, and the snowball continues to grow.

Conclusion

In the end, it did not matter whether Ronaldo snubbing Coke during an Euro 2020 press conference in Budapest caused the value of Coca-Cola to drop. Enough people believed it did, and it became the truth.

Full disclaimer: I have shares in Coca-Cola.

NOTES: I describe the impact of a lie so big it become the truth as the Ronaldo Effect. However, it has been used to describe other phenomena related to Cristiano Ronaldo’s personal footbal record, and was used to describe Ronaldo’s impact on Juventus’ share price (it more than doubled since he joined the team).

Because this blog is based on my personal views and experiences, it does not constitute financial advice.